what is a quarterly tax provision

16343 Interim provisionincome from equity method investments. The provision is the audit part of tax.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

The global provision process starts at the legal entity level in.

. Multiply the result by the tax rate 21 for federal tax on C-corporations. The first such period. An income tax provision represents the estimated amount of income tax expense that a company is required to accrue under GAAP for the current year.

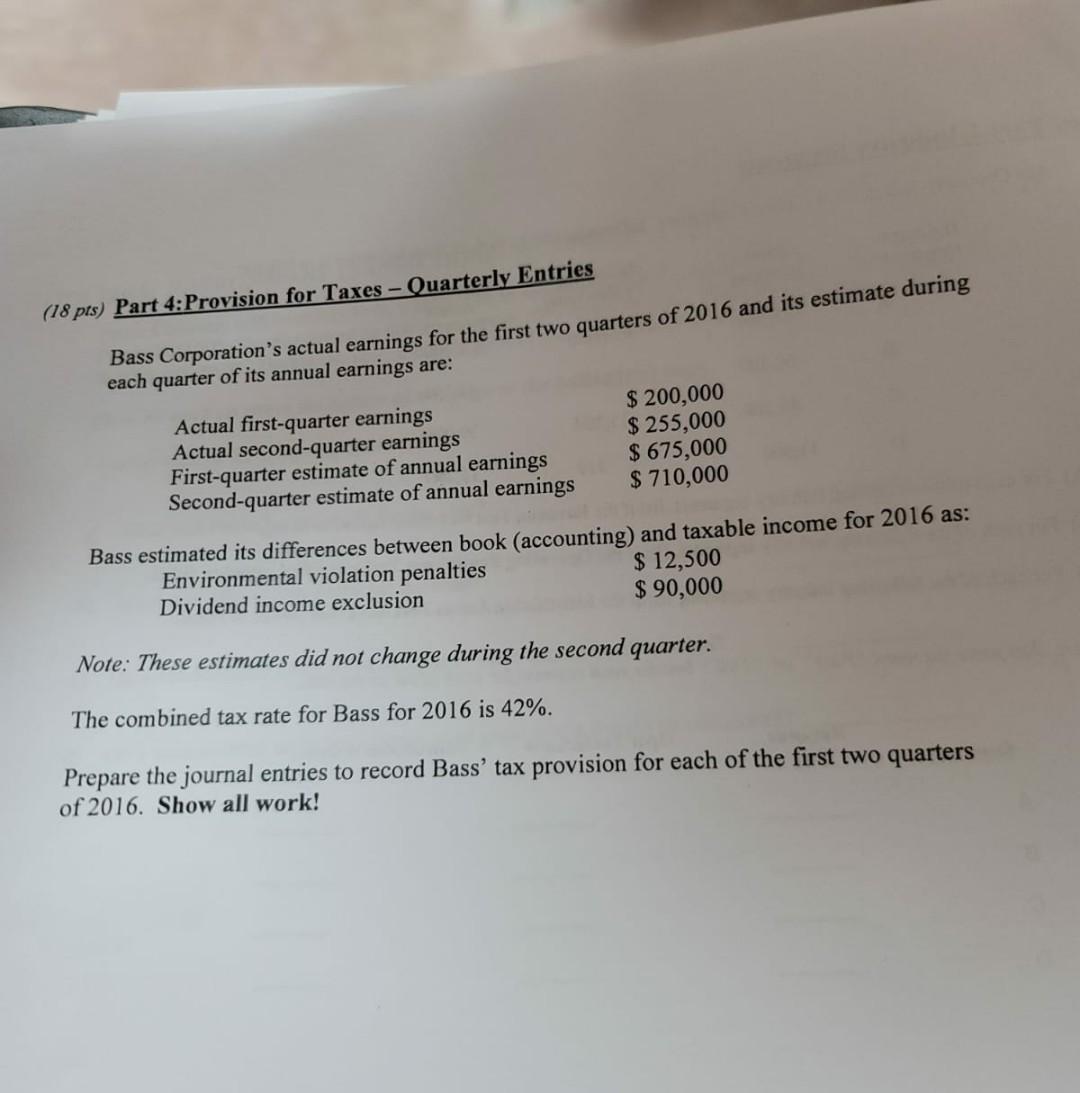

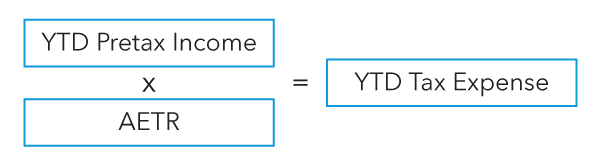

Ad Users Who Switch To FreshBooks Save Up To 265 Hours a Year On Invoicing and Accounting. The ETR is forecast quarterly on a consolidated basis and then applied to year-to-date income. Estimated Annual Taxes.

Estimated quarterly tax payments are tax payments made during the year on income that hasnt had withholdings taken by an. Now its time to add everything together and divide it into quarterly payments. Quarterly Hot Topics directly via email.

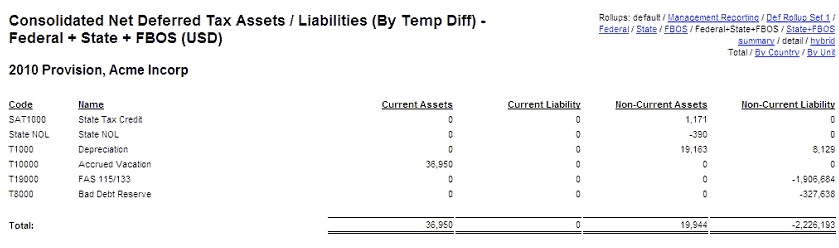

Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. If you calculate the exact amount each quarter you can skip the division. The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever-increasing scrutiny due to.

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. This guidance addresses the issue of how and when income tax expense or benefit is recognized in interim periods and distinguishes between elements that are recognized through. Tax rate changes in the quarter in which the law is effective Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the.

Recent editions appear below. Nonresident aliens use Form 1040-ES NR to figure estimated tax. The amount of this provision is.

Income Taxes Owed. Subtract usable tax credits tax credit carryforwards and the benefit of current year loss carrybacks. They work on a pay-as.

Quarterly Estimated Tax Periods means the two three and four calendar month periods with respect to which Federal quarterly estimated tax payments are made. A companys current tax expense is based upon current earnings and the. Current income tax expense and deferred income tax expense.

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Subscribe to receive Accounting for Income Taxes. The amount of this provision is.

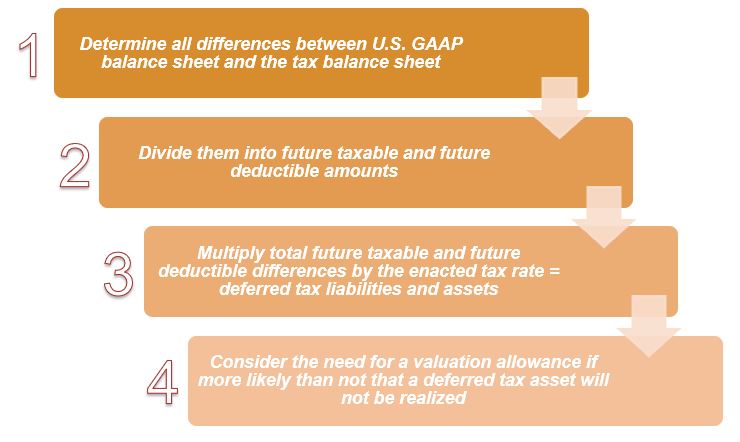

Heres an easy guide to help you get it right. A tax provision is comprised of two parts. Typically this is represented quarterly.

Divide your estimated total tax into quarterly payments. Quarterly taxes also referred to as estimated taxes are a type of taxation you must pay in advance of the annual tax return. What is a tax provision.

Since you owe more than 1000 in taxes the estimated annual tax is. Tax Provision Process The Tax Provision process enables you to prepare a full tax provision based on year-to-date numbers. What Are Quarterly Taxes.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax. Keep a Close Eye On Your Financials With Insightful Reports Make Smart Business Choices.

Solved 18 Pts Part 4 Provision For Taxes Quarterly Chegg Com

Axiostax Asc 740 Tax Provision Miami New York

Tax Manager Senior Resume Samples Velvet Jobs

Income Tax Accounting Sfas 109 Asc 2 Course Objectives Understand And Apply Basic Concepts And Procedures Of Sfas 109 Understand The How To Ppt Download

What Is An Income Tax Provision Henry Horne

Provision For Income Tax Definition Formula Calculation Examples

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

2021 Federal Tax Deadlines For Your Small Business

Asc 740 Interim Reporting Bloomberg Tax

Asc 740 Interim Reporting Bloomberg Tax

Tax Provision 2015 Fall Bus225l Class 9 Sjsu Mst Adjunct Prof Jeff Sokol Youtube

Tax Accounting Provisions Perspectives Analysis And News Deloitte Us

How To Calculate Quarterly Estimated Taxes In 2022 1 800accountant

Tax Senior Analyst Resume Samples Velvet Jobs